Good reads, good deeds and good people

You know those public service announcements that end with the familiar phrase, “The more you know . . .”? That’s how we look at our “News & Events” section. This is where you will find all sorts of useful information – from industry news to thought leadership in the form of blogs and videos, to company announcements highlighting innovative services, new members of our CIS family and more exciting news and events. All of which leave you, we hope, saying, “How about that – the more you know…”

FHFA NEWS RELEASE (7/11/2024):

FHFA Announces Release of Historical VantageScore® Credit Score by the Enterprises

As your business partner, Credit Information Systems knows how credit reporting and lending risk mitigation solutions help YOU efficiently manage your business. And we are here to support YOU with personalized experiences, expert advice, industry updates and innovative solutions that go above & beyond your expectations.

To help YOU remain current on changes impacting your business, we wanted to share an announcement published today, July 11, 2024, from the Federal Housing Finance Agency (FHFA).

Fannie Mae and Freddie Mac (the Enterprises) are making historical VantageScore® 4.0 credit scores available to approved users to support the transition to updated credit score and credit report requirements.

This comprehensive release is associated with single-family loans purchased by the Enterprise from April 2013 through March 2023, reflecting the period for which trended consumer credit data is reliably available across the three nationwide consumer reporting agencies.

These scores will provide market participants with the ability to better analyze and understand the new credit score models that have been validated and approved for use by Enterprises. The historical credit scores are available for download at the Enterprises’ respective websites.

Click Here to link to the official News Release.

If you have any questions or need assistance, please contact your Account Manager at 800-782-9094.

THANK YOU FOR YOUR BUSINESS! We are here to support YOU as we continue to expand the breadth of products & services we offer, so YOU can better serve your customers and remain compliant.

We Are Pleased to Announce

We Are Pleased to Announce

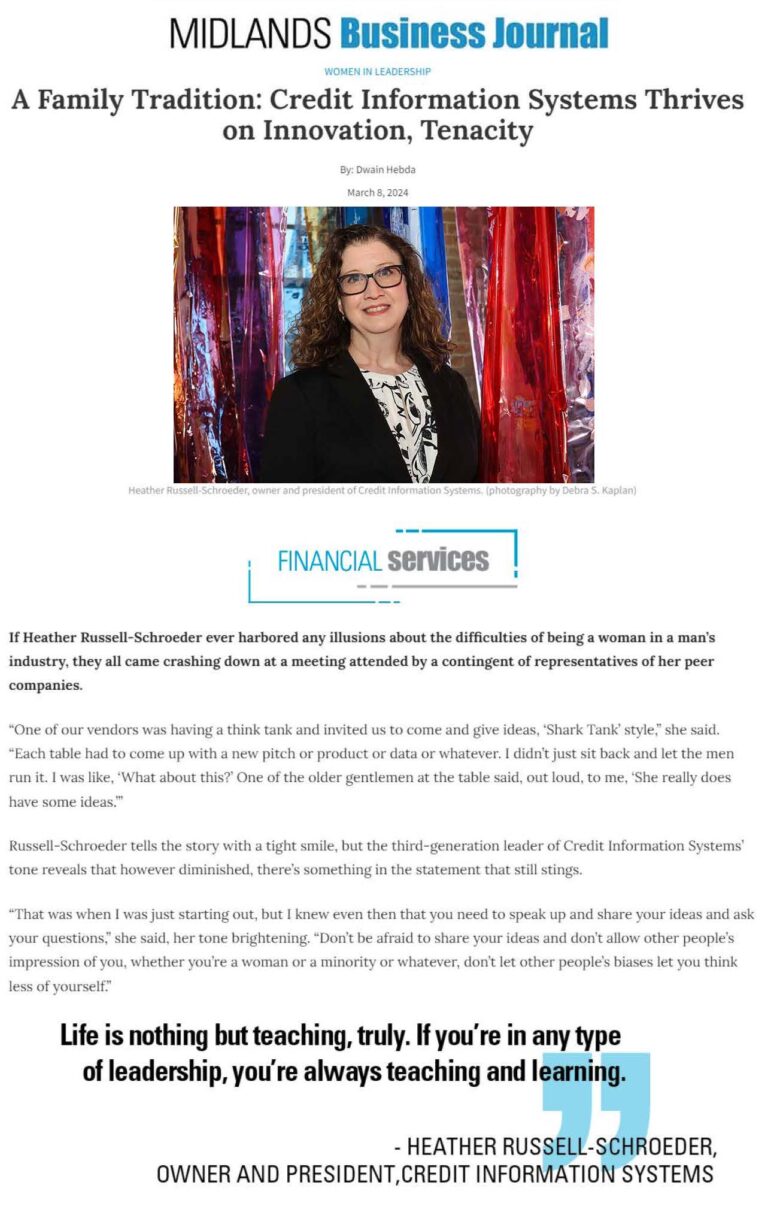

Heather Russell-Schroeder, Owner/President of Credit Information Systems, is the new President of the Board of Directors of the National Consumer Reporting Association (NCRA), a national trade organization of consumer reporting agencies and associated professionals who provide products and services to mortgage lenders and property managers using consumer reports for housing decisions.

The National Consumer Reporting Association promotes the general welfare of its members: credit reporting agencies, tenant screening companies, employment screening companies, and all issuers of consumer reports, as well as the businesses they serve and the consumers whose information they report. They provide leadership in education, legislation, ethics, and enhanced vendor relations to enable members to meet the needs of business and the modern consumer under the Fair Credit Reporting Act.

The team at Credit Information Systems congratulates our leader on her new important role in this respected and impactful organization.

Credit Information Systems Represents

Please join us in congratulating Credit Information Systems Senior Account Manager, Mike Osbourne, as he was recently elected to the Nebraska Mortgage Association’s (NMA) Board of Directors and will begin serving a three-year term in January 2024. The NMA is a non-profit trade association representing the mortgage lending interests of banks, mortgage bankers, mortgage brokers, credit unions, and commercial lenders for 40+ years. The NMA works on behalf of its members to improve communications, generate goodwill, and create an informed and ethical membership among mortgage lenders. Mike will be a great addition to this very appreciated and effective group of professionals, and the team at Credit Information Systems and Star Appraisal Management are happy to support him in his new position.

Exciting News from Fannie Mae® & Appraisal Firewall

In continuation of efforts to make the home valuation process more efficient and accurate, Fannie Mae is transitioning to various options to establish a property’s market value, with the option matching the risk of the collateral and the loan transaction. Focused on preparing for the future of appraisals, Appraisal Firewall, along with Star Appraisal Management Company, Credit Information Systems & Accurate Financial Services, will be prepped and ready to deliver the options to lenders for Value Acceptance, Value Acceptance + Property Data, and Hybrid Appraisals as of 4/15/2023. For more information, click here.

New Website Launch for Credit Industry Leader

If you want to know more about a client-focused company that’s been in business for more than 100 years, go now to the new website for Credit Information Systems, https://unruffled-turing.66-175-232-200.plesk.page/. This new website, which launched on June 1st, tells the story of Credit Information Systems, a third-generation family-owned company, dedicated